So Britain is no longer part of the EU. In an unexpected turn of events, the Leave side pulled off the victory by a narrow margin. Now although, it will still take awhile for the dust to settle and Britain to officially leave the EU – Brussels has already indicated they want the UK to leave ASAP.

What was the immediate reaction?

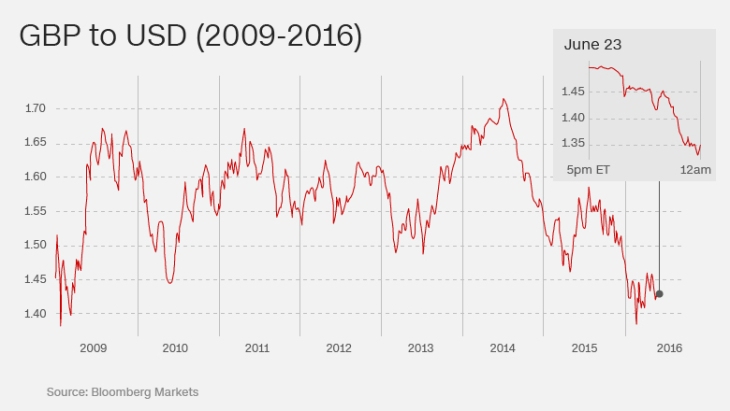

As seen by the turn of events on Friday following the result – markets around the world were in a whirlwind with the Dow Jones dropping over 600 points and the TSX dropping over 200 points. Britain’s currency dropped sharply against all major currencies.

Should I Panic?

The short answer is NO!

What is important to note, is that after each significant economical event that has gone against expectations – the markets will always respond negatively. This is due to several factors:

1: The biggest factor is uncertainty. Few people predicted Britain would actually leave the EU: Because of this, no one knows Britain’s next move. They are still viable economically – holding the worlds number 5 rank in terms of GDP – a solid 5 slots above Canada.

2. Market Sell-Off:

Over my time as an investor, I have realized a few things – one of the most important aspects is after an unprecedented and highly important event such as Brexit – markets are always volatile. The same happened on Friday – with the markets dropping all around the world. Many retail investors (us) are scared and fearful so we sell our stocks and other investments at lower prices to secure our capital and wait until the dust is settled. What happens is because of the large volume of selling that is taking place – stocks drop. Many times, there is nothing inherently wrong with the company – but fear will drag it down. The best moves in these situations is to do nothing – weather the storm and look for market opportunities.

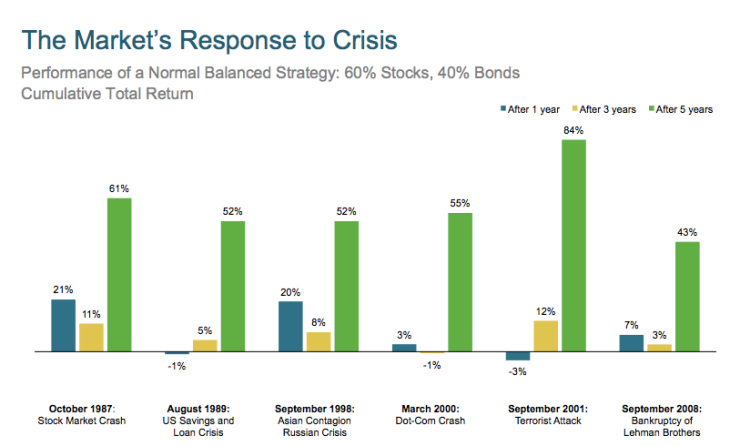

Below is a chart that graphs the market’s response to major global events

- Graph depicts diversified portfolio

The Good?

Renowned Investor Warren Buffett once said: “ Be greedy when others are fearful and be fearful when others are greedy”

Stock Opportunities:

Key Companies such as Barclays Bank, Lloyds Group and JP Morgan Chase (all renowned institutions worldwide) saw massive drops.

Both Barclays and Lloyds Group saw drops of over 20% with JP Morgan seeing a drop of 6%. It is obvious investors have hit the sell button. Investor knowledge revolves around buy low and sell high. Now, I do know that markets will be volatile for quite some time but in no comparison to the volatility experienced after the events above – markets will rebound but no one knows when. This may not be the lowest the market goes – but after such a drastic drop it would be foolish not to use this as an entry point into the market to yield some significant gains for your investments.

*The above are examples, many other opportunities exist.

Currency Opportunities: Another opportunity that presents itself is in forex markets. The British pound dropped to low levels on Friday. The British pound lost about 8% against the Canadian Dollar and about 12% against the US Dollar. Both provide solid opportunities to obtain solid returns in the short term. Remember the foreign exchange markets are volatile and monetary policies and moves by the Bank of England will move the pound in the coming weeks.

Source: Bloomberg Markets, CNN Money

The Bad?

Investors on Friday flocked to gold and safe havens such as bonds. The price of gold responded going up 50$ an OZ touching over 1300$ per OZ on Friday. All this means, is investors are fearful as gold has long been sought to be a very safe bet during significant market volatility and downturn. Now this is not bad per se, but when gold is high – we usually associate it with a lot of fear and insecurity on the part of investors. However, if the market faces further headwinds – expect the price of gold to go up.

The Worst?

Britain is divided and no one knows what will now happen with Scotland, Wales and Northern Ireland. Brussels is furious and has stated they wanted a quick exit by the Brits. Separating Britain from the EU will be a grueling process – many many things will have to be redone and re-negotiated.

Disclaimer: Please be aware all of the above is my own personal opinion. The stocks provided are just examples as they experienced substantial drops in the market. They are many other opportunities available in the market. Please be aware markets and forex markets will be volatile for the near future – please do your research before making moves.

Cover Image: Source: Eater.com