Continuing our mini-series on mutual funds, I feel like it’s a good idea to talk about strategy. Before laying the roots for your portfolio it’s a good idea to choose your strategy – something that fits your needs and something you feel comfortable with.

Investors usually follow one of four strategies: Income(dividend), Index, Growth and Value Investing.

Scenario 1: Dividend Investing

To sum up income investing, an investor is looking for a steady stream of income derived from their investments. Essentially you get a big fat cheque for doing little to no work! Dividends and reliable yields are the name of the game. These can usually be found in the version of bonds (later), ETF’s and stocks such as those utility companies, banks and large companies that dominate the Fortune 500. It’s one of the most reliable and straightforward investing strategies.

How do I go about choosing a dividend stock?

There are a few metrics one considers when buying a dividend stock. The most important is the Dividend Yield. The yield is simply the annual dividend divided by the stock price. If a company pays 3$ in dividends with a stock price of 100$ the yield is 3%. The driving principle here is pretty straightforward – find reliable companies that pay a strong yield so you as an investor can receive a steady stream of income.

In addition to this, look at the company’s history considering dividends. Does the company increase it and by what rate? Have they ever cut their dividends and why?

Below is a list of the Dividend Aristocrats- companies in the US that have increased their dividends annually for the past 20 years. https://en.wikipedia.org/wiki/S%26P_500_Dividend_Aristocrats

As you can see the majority are household names that dominate the market today.

Note: In addition, all the Dividend Aristocrats (companies that have raised dividends for years now) are tracked by an ETF – Ticker SDY – which allows an investor to trim costs and spread risk across all the companies rather then choosing one. — The same can be done with a mutual fund.

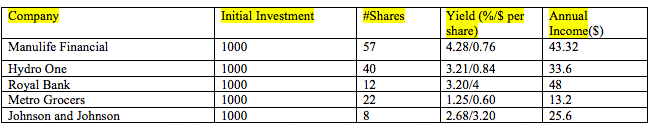

What does a sample portfolio look like? Examples only.

Annual Total = 163.72 Annual Total from Basic Interest = 50$ Difference = 113.72$

Remarks: As you can see, each yield in percentage is significantly higher then the interest rate offered by major banks – let’s assume its 1%. The yields also exclude capital appreciation so for example if Manulife’s stock grows by 5% annually you will receive 9.3% due to dividends.

Where do investors go wrong?

One important factor and I cannot stress this enough is: do not chase high yields!! Do not simply choose a dividend stock due to its high yield.

In Taxation, dividends a are paid out from the retained earnings or the profit. You do not want a company paying out large sums in dividends when the money can be used to further boost the bottom-line of a company.

In addition, sometimes large yields are unstable and a company may be offering large yields to attract investors. Check to see if the yields are sustainable over the long term and the company has solid fundamentals.

Investors must also realize, that dividend stocks are less likely to generate high returns (like 15-20% a year). A significant portion of returns are through dividends. Patience is critical with income investing – as it is only with time that investors can seek to reap the benefits associated with dividends and subsequent increases.

What about risk?

Like any market related activity, dividend investing does come with risk. Choose reliable companies that have a history of paying out solid dividends. In addition, large companies that have powerful brand names are less likely to go bust. In my personal opinion, dividend investing falls under the category of semi-conservative to semi-aggressive investing. — more on this later.

What dividend stocks are you invested in?

As for me, I’m invested in many of the companies listed above including but not limited to large companies such as American Express Group, Couche-Tard and Manulife. Some of my financial goals for the future is to generate a large sum of money through dividends to offset some of my personal expenses and achieve financial freedom at a younger age.

Note: I know, I mentioned mutual funds at the beginning… Most of the material mentioned here can be applied to mutual funds as well. Mutual funds will pay out dividends in the form of distributions – the ones with higher percentages are most likely funds that track dividend stocks. In addition, mutual funds will show you the holdings of the fund which will tell you exactly what kind of strategy the fund is trying to mimic.

Disclaimer: All of the above information is my own personal opinion. The stocks and investments presented are examples only.

If you have any questions leave a comment here!