These days, youngsters are very cautious when it comes to investing their money. After hearing all the horror stories from 2008 – youngsters have lost faith in the overall market which has resulted in confusion on where to seek out returns from – resulting in a significant portion of money being left as cash. While the old expression cash is king never ceases to amaze me – cash is low risk but low return.

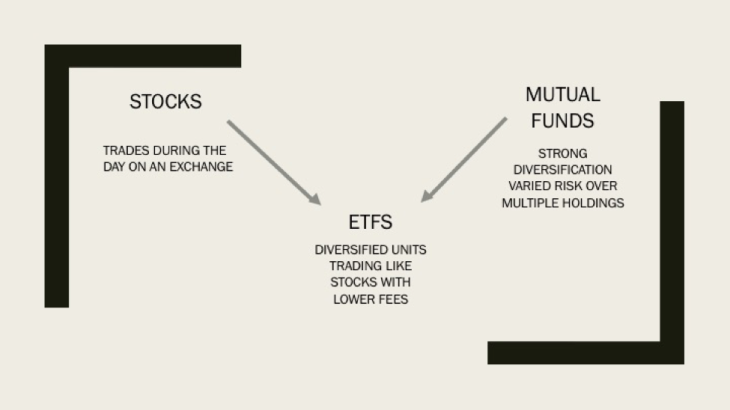

One of the best things hitting the market these days are ETF’s or exchange traded funds. I’m sure you have heard of mutual funds (TBD later) well think of ETF’s as a mutual fund on steroids or a mutual fund 2.0. ETF’s are surging in popularity these days mainly due to the fact it’s a combo product (stock + mutual fund). Like stocks, ETF’s are traded on an exchange like the DOW or TSX with the price fluctuating during the day. Like mutual funds it can track indexes, hold stocks and bonds and attempt to replicate the performance of its holdings.

Benefits Snapshot at a Glance

| 1. Ultra Low FEES: 0.44% on Average compared to 2.3% for Mutual Funds (% per year) |

| 2. Trading Flexibility |

| 3. Diversification – There’s an ETF for almost anything |

- One of the greatest benefits with ETF’s is their ultra low trading management fees. On average in the overall market the overall fee for ETF’s is 0.44% which is great. On a mutual fund you would be paying 3%. The higher the number, the more money you are handing over to management. Finding ways to lower fees without compromising returns will also put more money in your pocket. On a 1000$ invested the difference works out to about 20$. On a 10,000 portfolio you’re looking at a difference of about 200$. As you recall from my earlier posts, I hate fees so any chance I get to lower them is like Christmas for me.

2. Another great benefit of ETF’s is knowing the selling price of the product. This gives it added flexibility over mutual funds. Unlike mutual funds which only release the price or NAV (net asset value) at the end of the trading day, the price of ETF’s is constantly changing throughout the trading day. Investors do not need to wait till the end of market close to know the current price. Although you can place an order for a mutual fund at anytime – waiting till the end of the day is the only way to know the price. Mark my words, there is nothing wrong with this – but the added flexibility of knowing the price at all times makes managing a portfolio a lot easier especially when the time comes to sell units.

2. Another great benefit of ETF’s is knowing the selling price of the product. This gives it added flexibility over mutual funds. Unlike mutual funds which only release the price or NAV (net asset value) at the end of the trading day, the price of ETF’s is constantly changing throughout the trading day. Investors do not need to wait till the end of market close to know the current price. Although you can place an order for a mutual fund at anytime – waiting till the end of the day is the only way to know the price. Mark my words, there is nothing wrong with this – but the added flexibility of knowing the price at all times makes managing a portfolio a lot easier especially when the time comes to sell units.

3. The other day, I asked a friend on how to invest in Africa – his response: there must be an ETF. My point is: ETF’s have grown so much in the past years, chances are if there is an industry or region you would like to invest in chances are there’s an ETF for it. You can also go the traditional route by finding an ETF that tracks an index – but ETF’s can be found for commodities, specific industries, group of stocks, bonds and just about any other asset class. Just do some research and I’m sure you will find what you are looking for. In addition, if you are undecided on which specific stocks to buy, you can choose to buy an ETF holding a combination of those stocks – effectively spreading your risk.

Disclaimer: All of the above information is my own personal opinion. Please do you research before choosing an ETF. Verify fees and expense ratios as well as holdings before investing. The quoted fees above are averages for the North American Markets – they do vary from fund to fund. For additional information on ETF’s selections, general info and detailed definitions you can visit Vanguard ETFs and Investopedia (others as well).

References:

For Pictures:

Looking forward to the blog about mutual funds!

LikeLike