If I had to choose one introductory investment product for my hard earned savings that combined the terrific growth opportunities of stocks and diversity of a basket fund it would have to be a mutual fund. To put it simply, a mutual fund is simply a collection of various stocks, bonds and cash that is split into various units that investors can purchase. It spreads risk because each unit is made of many many different holdings and the chances of all of them performing poorly are next to none.

This week we will be looking into our second mini-series which will cover mutual funds and developing an investment strategy and in the coming weeks various ways you can strategize your portfolio according to risk, desired returns and capital distributions.

Why are Mutual Funds a good place to start?

One of the reasons why mutual funds are highly sought after is because it is kind of like your all-in-one product. It offers diversity in the sense of multiple holdings. It doesn’t make you pick individual stocks for your portfolio (many individuals lack the knowledge to do so) and it saves your precious time and energy when making your investment selections. They are very easy to purchase and usually applications can be done online in the matter of minutes. In addition, when it comes to mutual funds the options are endless – there is a mutual fund for each industry, all the major indexes, major companies according to size and some funds include bonds as well.

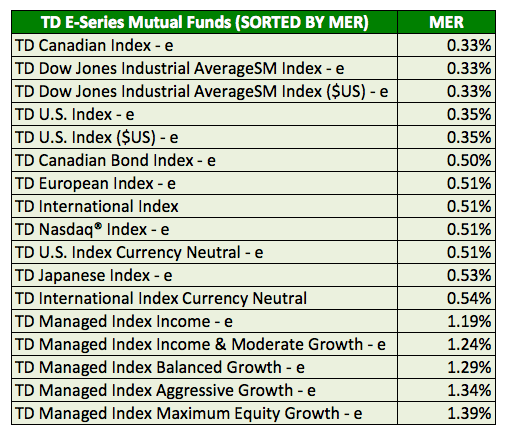

*For illustrative purposes only. For example, this is a list of TD’s E series mutual funds with the MER listed. There are over a dozen here and this is not including their main selection. Each institution usually has their own collection of mutual funds.

What are they?

As mentioned before, a mutual fund is a collection of assets invested in various stocks, bonds and some cash holdings. The total assets are divided and prices into units (NAV’s – net asset value) which the general public can purchase. There is usually a fee associated with owning mutual funds – MER which is the management expense ratio. The MER is not standard among funds and can vary. Always remember a high MER does not necessarily mean higher returns.

How do they differ from other investments?

Once upon a time, mutual funds were very unique and it is only now that with the rise of ETF’s (exchange traded funds) that their reign is being thwarted. As mentioned in my previous article ETF’s taking the market by storm – the main difference Is that ETF’s are listed on an exchange like the DOW and mutual funds do not trade on an exchange. ETF’s are priced throughout the market day but mutual funds are priced at the end of the trading day. Mutual funds however, will always maintain their diversification which is essential to portfolio building. Since the mutual fund holds so many various assets – your eggs are very spread-out and the chances of companies performing poorly is heavily spread-out. For example, if you had 1000$ in a single stock and that stock fell 10% you would lose 100$. However, a mutual fund that has 100 holdings and one of the holdings drops by 10% – in theory you would only lose only 1$.

Are they safer then stocks?

One thing to keep in mind, is that every investment product has risk. Whether it be interest risk or market risk –these are still risks that need to be accounted for. Because of added diversification, mutual funds are deemed to be “safer then stocks”.

How do I purchase them?

Mutual funds can be purchased from your bank. They do not require a high upfront investment with some mutual funds even allowing a 100$ minimum purchase. The best way to learn and gain knowledge is to try!

Disclaimer: All of the above information is my own personal opinion. Please be aware that mutual funds are not a guaranteed investment and research should be done before selecting mutual funds. Mutual funds may also come with additional fees beyond the MER such as early redemption fees and many others – please consult the appropriate documents before making a purchase.

References:

Cover Picture: http://timesofindia.indiatimes.com/articles/Why-Should-You-Invest-in-Mutual-Funds/articleshowhsbc/24183043.cms